NY law ch 340 2010-2026 free printable template

Show details

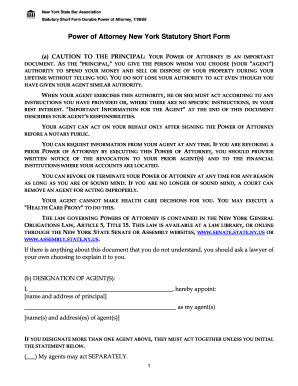

New York State Bar Association New York Statutory Short Form Power of Attorney 8/18/10 Eff. 9/12/10 POWER OF ATTORNEY NEW YORK STATUTORY SHORT FORM a CAUTION TO THE PRINCIPAL Your Power of Attorney is an important document. As the principal you give the person whom you choose your agent authority to spend your money and sell or dispose of your property during your lifetime without telling you. You do not lose your authority to act even though you have given your agent similar authority....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ny state statutory short form power of attorney

Edit your nys power of attorney form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your power of attorney new york statutory short form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new york state power of attorney form online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ny power short form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out power of attorney form nys

How to fill out NY law ch 340

01

Obtain a copy of NY Law Chapter 340 from the official state website or appropriate legal resources.

02

Read the guidelines stated in Chapter 340 to understand the requirements and implications.

03

Gather necessary documentation that may be required for the filling process.

04

Complete the form accurately, ensuring all sections are filled out as per the guidelines.

05

Double-check all information for accuracy before submission.

06

Submit the completed form as directed in the law, either online or by post.

Who needs NY law ch 340?

01

Individuals or entities seeking legal remedies under the specific provisions of NY Law Chapter 340.

02

Professionals like lawyers or representatives who assist clients with claims under this law.

03

Anyone affected by circumstances addressed under this chapter, needing to file a claim or seek relief.

Fill

nys consent to change attorney form

: Try Risk Free

People Also Ask about attorney business

Does a New York power of attorney need to be notarized?

New York's new POA law requires that the principal's signature be notarized in addition to the POA being signed with two witnesses present (note that the notary can be one of your witnesses).

How do I get a durable power of attorney in NY?

How to make a New York power of attorney Decide which type of power of attorney to make. Decide who you want to be your agent. Decide what authority you want to give your agent. Get a power of attorney form. Complete the form, sign it, and have it witnessed and notarized.

Does NY have durable power of attorney?

Overview. The NYSLRS Special Durable Power of Attorney (POA) document allows someone else, referred to as the “agent,” (for example, a trusted friend or family member) to act on your behalf regarding retirement benefit transactions.

What does statutory short form mean?

A statutory form is a form created by a government, usually designed to serve as a model form or a free form for the public. The text of the form resides within the government's statutes. For example, many states have statutory durable powers of attorney forms written into their laws.

What is a durable power of attorney form New York?

A New York durable statutory power of attorney allows a person to hand over the power to handle their finances to someone else, and remains valid during their lifetime. The person giving power (“principal”) can choose to give limited or broad powers to their selected individual (“agent”).

Is New York statutory short form durable?

Create a high quality document online now! A New York durable statutory power of attorney allows a person to hand over the power to handle their finances to someone else, and remains valid during their lifetime.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the new york state power of attorney statutory short form in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your nys statutory short form power of attorney in seconds.

How do I fill out the nys power of attorney form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign new york state power of attorney and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit ny statutory short form power of attorney on an Android device?

You can make any changes to PDF files, such as power of attorney new york state, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is NY law ch 340?

NY law chapter 340 refers to legislation that governs certain legal and procedural requirements in the state of New York.

Who is required to file NY law ch 340?

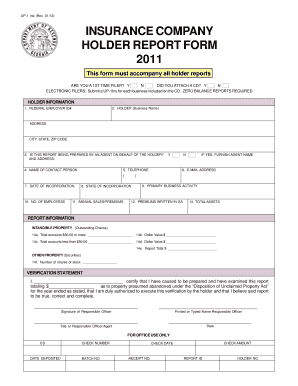

Entities or individuals specified in the legislation, such as businesses, organizations, or professionals operating within the jurisdiction of New York, may be required to file under NY law chapter 340.

How to fill out NY law ch 340?

To fill out NY law chapter 340, individuals or entities must obtain the appropriate forms from the relevant New York state department, provide the required information accurately, and submit the forms as per the guidelines provided.

What is the purpose of NY law ch 340?

The purpose of NY law chapter 340 is to establish and enforce specific regulations that promote accountability, transparency, and compliance among individuals and entities operating in New York.

What information must be reported on NY law ch 340?

The information that must be reported on NY law chapter 340 typically includes identification details of the filer, relevant financial data, and any specifics required by the regulatory authorities for compliance.

Fill out your NY law ch 340 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New York Short Form is not the form you're looking for?Search for another form here.

Keywords relevant to law ch 340

Related to nys power of attorney short form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.